2022 tax refund calculator canada

The Canada Tax Calculator provides State and Province Tax Return Calculations based on the 20222023 federal and state Tax Tables. 8 rows If you get a larger refund or smaller tax due from another tax preparation method well refund the amount paid for our software.

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

We strive for accuracy but cannot guarantee it.

. 2021 free Canada income tax calculator to quickly estimate your provincial taxes. Canada Tax Calculator 202223. Or if you need more help talking it through get a free phone consultation with one of our household experts.

Any additional income up to 98040 will be taxed at the same rate. Reflects known rates as of January 15 2022. Calculations are based on rates known as of March 29 2022 and includes changes from the New Brunswick 2022 budget.

TurboTax Free customers are entitled to a payment of 999. Use our simple 2021 income tax calculator for an idea of what your return will look like this year. Claims must be submitted within sixty 60 days of your TurboTax filing date no later than May 31 2022 TurboTax Home Business and TurboTax 20 Returns no later than July 15 2022.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The 31st day after you file your return. Here is a list of credits based on the province you live in.

Get better visibility to your tax bracket marginal tax rate average tax rate payroll tax deductions tax refunds or taxes owed in 2021. Taking advantage of deductions. The calculator reflects known rates as of January 15 2022.

Meet with a Tax Expert to discuss and file your return in person. The best free online tax calculator for Canada. Calculations are based on rates known as of March 16 2022.

The 2022 tax year runs from 1 st january 2022 through to the 31 st december 2022 in ontario with tax returns due for specific individuals groups on the following dates. 2022 RRSP savings calculator. That means that your net pay will be 40568 per year or 3381 per month.

Assumes RRSP contribution amount is fully deductible. The CRA will pay you compound daily interest on your tax refund for 2021. Have a refund of 2 or less.

There are a variety of other ways you can lower your tax liability such as. Interest on your refund. This calculator is for 2022 Tax Returns due in 2023.

The Canada Annual Tax Calculator is updated for the 202223 tax year. Youll get a rough estimate of how much youll get back or what youll owe. The Canada Tax Calculator by iCalculator is designed to allow detailed salary and income tax calculations for each province in Canada.

To calculate your tax multiply the amount of your self employment income by 9235. File your taxes the way you want. Annual Tax Calculator 2022.

It includes very few tax credits. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. For example in the 2021 tax season if you earn 80000 you will be in the 49020 to 98040 tax bracket with a tax rate of 205.

Calculate your tax bill and marginal tax rates for 2022. Calculate your combined federal and provincial tax bill in each province and territory. If you filed your 2020 return and qualified for interest relief you have until April 30 2022 to pay any outstanding income tax debt for the 2020 tax year to.

Start with a free eFile account and file federal and state taxes online by April 18 2022. To lower the amount you owe the simplest way is to adjust your tax withholdings on your W-4. It does not include every available tax credit.

Tinies recommends these childcare payroll. This means that you are taxed at 205 from your income above 49020 80000 - 49020. 2022 Personal tax calculator.

Calculate the tax savings your RRSP contribution generates in each province and territory. Your pay frequency may differ such as if youre paid bi-weekly semi-monthly or monthly. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432.

Use the simple annual Canada tax calculator or switch to the advanced Canada annual tax. This calculator is intended to be used for planning purposes. Use the Canada Tax Calculator by entering your salary or select advanced to produce a more detailed salary calculation.

40000 x 15 20000 x 15 6000 3000 3000 in net federal tax. If you make 52000 a year living in the region of ontario canada you will be taxed 11432that means that your net pay will be 40568 per year or 3381 per month. Please enter your income deductions gains dividends and taxes paid to get a.

The day after you overpaid your taxes. This calculator is intended to be used for planning purposes. Since April 30 2022 falls on a Saturday in both of the above situations your payment will be considered paid on time if we receive it or it is processed at a Canadian financial institution on or before May 2 2022.

Average tax rate taxes payable divided by actual not taxable. For example if your non-refundable credits total 20000 and your taxable income is 40000 you are in the first tax bracket. Stop by an office to drop off your documents with a Tax Expert.

If you are looking to compare salaries in different provinces or for different salary. How Does The Tax Return Estimator WorkEstimate Your 2021 Tax Refund TodayTerms And Conditions May Vary And Are Subject To Change Without NoticeTax Filing Season Always Begins In September After The Tax Year FinishesYou Will Need To Compare The Advance Child Tax Credit Payments You Received In 2021 With The Amount. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

For more information see Prescribed interest rates. 2022 indexation brackets rates have not yet been confirmed to CRA data. The calculation will start on the latest of the following three dates.

Your average tax rate is 220 and your marginal tax rate is 353. We strive for accuracy but cannot guarantee it. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2022 Tax Tables.

Ontario Income Tax Calculator Calculatorscanada Ca

Capital Gains Tax Calculator For Relative Value Investing

Taxtips Ca 2021 And 2022 Investment Income Tax Calculator

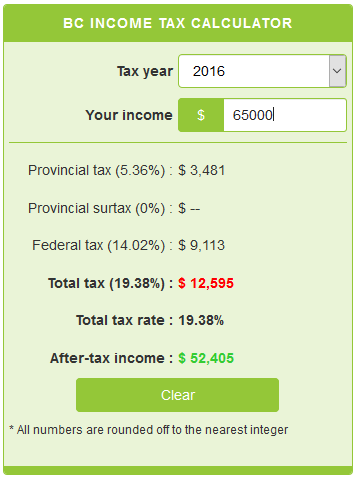

British Columbia Income Tax Calculator Calculatorscanada Ca

How To Calculate Your Tax Refund 2022 Turbotax Canada Tips

Capital Gains Tax Calculator For Relative Value Investing

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Exercise Calculate A Refund Or A Balance Owing Learn About Your Taxes Canada Ca

Cerb Tax Calculator Cerb Tax Rate Kalfa Law

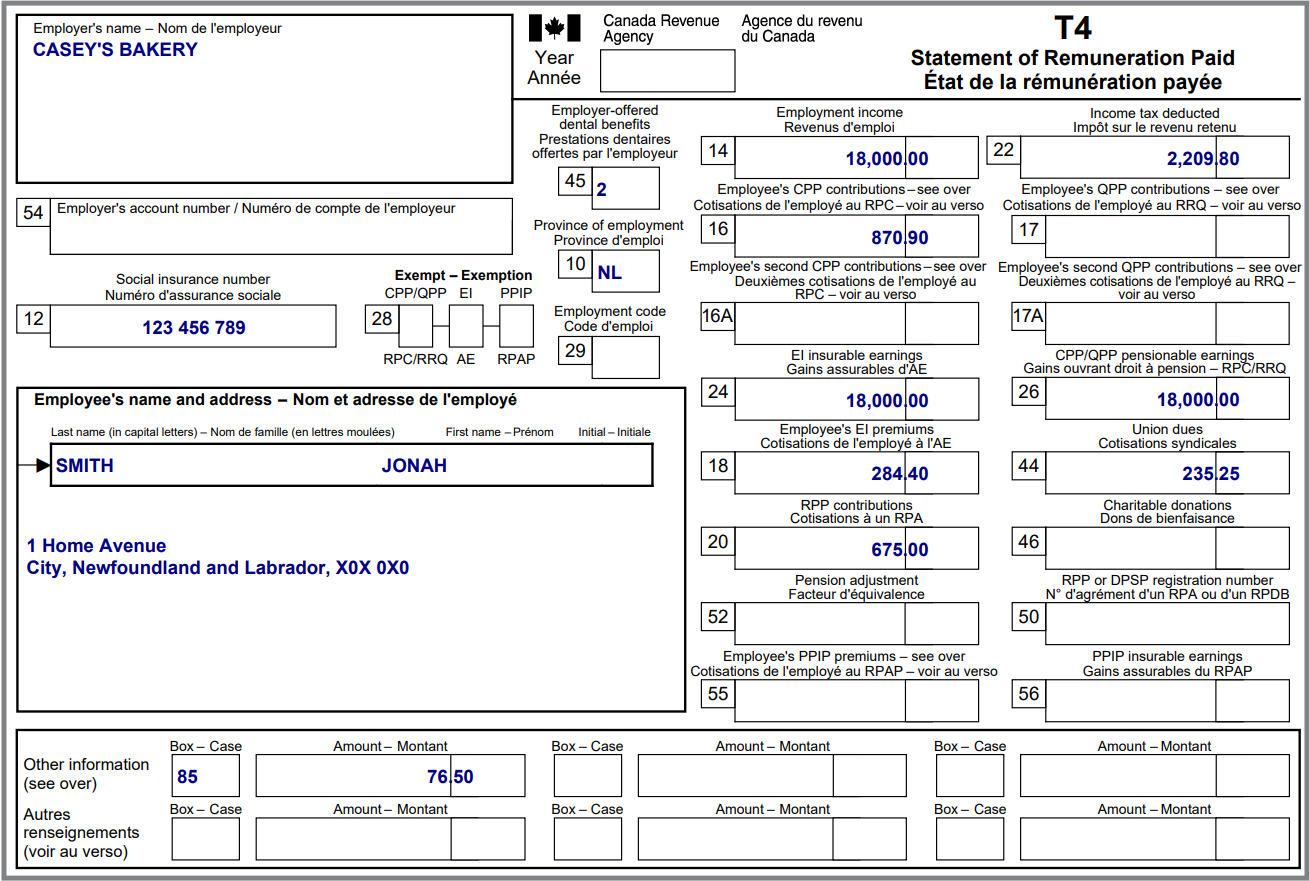

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Your 2022 Tax Fact Sheet And Calendar Morningstar

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

Canada Tax Filing Deadline 2021 Key Dates

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Income Tax Calculator Calculatorscanada Ca

Ca Income Tax Calculator May 2022 Incomeaftertax Com

2021 2022 Income Tax Calculator Canada Wowa Ca

Apply For A Canadian Tax Refund Workingholidayincanada Com

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips